When you rent a car from Dollar, the company places a temporary hold of around $200 to $500 on your credit card, depending on the location and type of vehicle.

This amount isn’t an actual charge; it’s just a security deposit that covers possible extra costs like fuel, tolls, parking tickets, or late returns.

Once you bring the car back in good condition and your final bill is settled, the hold is released automatically, usually within a few business days.

Understanding this process helps you plan your credit card limit better, avoid surprises at the rental counter, and enjoy a smoother travel experience with Dollar.

What Is a Credit Card Hold When Renting a Car?

A credit card hold, often called a security deposit, is a temporary amount that a rental company freezes on your credit card when you pick up a car.

It isn’t a charge or payment; it’s simply a way for the company to make sure funds are available if there are any extra costs, such as fuel charges, late returns, or minor damages.

The exact hold amount depends on factors like the car type, rental location, and payment method, but it’s typically between $200 and $500.

Once you return the vehicle on time and in good condition, the hold is removed. However, it may take a few business days for the funds to appear as available in your account again.

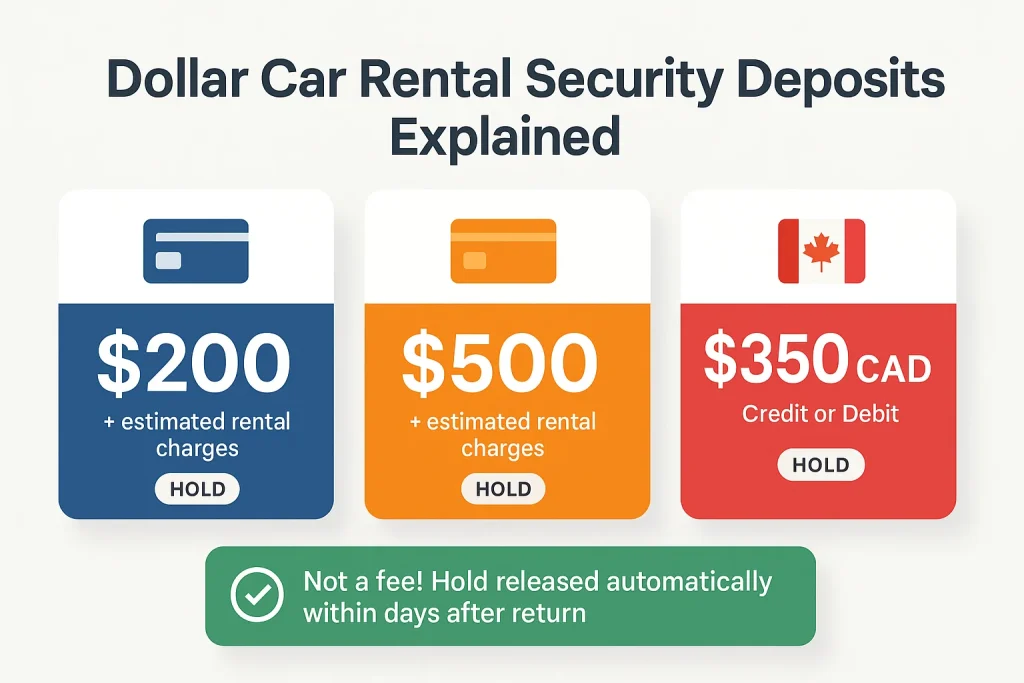

How Much Is the Security Deposit for a Dollar Car Rental?

Dollar Car Rental places a temporary security hold on your card when you pick up a vehicle. This amount covers any potential extra costs, like fuel, tolls, or damage, during your trip.

The deposit depends on how you pay: if you use a credit card, Dollar typically holds up to $200 in addition to your estimated rental charges.

If you pay with a debit card, the hold increases to around $500. For Canadian rentals, the standard hold is $350 CAD, whether you use a credit or debit card.

This isn’t a fee, it’s just a temporary authorization. Once you return the car in good condition and close out your rental, the hold is released automatically, usually within a few business days.

Dollar Car Rental Credit Card Hold Explained

When you rent a car from Dollar, the company places a temporary hold on your credit card, usually up to $200 in addition to the total rental amount.

This hold isn’t an extra charge; it’s a security deposit to cover potential costs such as damage, fuel, or late return fees.

Once you bring the car back in good condition and the final bill is settled, Dollar releases the hold. The funds typically become available again in 3 to 5 business days, depending on your bank’s processing time.

What Does Dollar Car Rental Put on Your Debit Card as a Hold?

When you rent a car from Dollar using a debit card, the company places a temporary hold on your account to secure the rental payment and cover any potential extra charges. Typically, this hold is around $500, and the money stays unavailable until you return the vehicle.

If you’re renting from an airport location, Dollar requires two valid forms of ID and proof of a return flight for verification.

In some cases, they may also perform a credit check to confirm your eligibility. However, if you’re a Dollar Express member, this $500 hold is usually waived after your first successful rental.

How to Rent a Dollar Car with No Deposit?

Renting a Dollar car without a deposit isn’t always guaranteed, but you can reduce or even avoid it in a few smart ways.

The easiest method is to use a major credit card like Visa, MasterCard, or American Express, and Dollar usually places only a small temporary hold instead of charging a full deposit.

Make sure you follow all rental requirements, such as bringing a valid driver’s license and using a credit card that matches your name.

If you’re paying with a debit card, Dollar may ask for extra verification, like a return flight ticket or a quick credit check, to ensure your eligibility. Another simple tip is to book your car in advance.

Early booking gives Dollar more time to confirm your details, which can help reduce or remove the deposit amount.

How to Avoid or Reduce the Dollar Car Rental Deposit?

Completely avoiding the Dollar car rental deposit isn’t usually possible, but you can definitely lower it with a few smart steps.

- Use a credit card instead of a debit card: Credit cards are considered lower risk for rental companies, so Dollar often places a smaller hold of around $200 instead of $500 for debit card users.

- Maintain a clean rental history: If you’ve rented from Dollar before and returned cars on time and in good condition, you may qualify for a reduced or waived deposit hold.

- Choose standard or economy cars: Higher-end vehicles require larger deposits because they carry more financial risk. Opting for a basic model helps keep your hold amount smaller.

- Review your booking details: Deposit policies can vary by location and season, so always check the latest Dollar terms before pickup to avoid surprises.

In short, while you can’t skip the deposit entirely, using the right payment method, keeping a solid rental record, and choosing the right car can help you minimize how much money is held on your card.

What Are the Best Credit Cards for Dollar Car Rentals?

Dollar Car Rental accepts most major credit cards, including Visa, MasterCard, American Express, Discover, Diners Club, JCB, Carte Blanche, and China Union Pay.

Using a credit card doesn’t just make payments easier; it can also help you reduce or avoid large security deposits and unlock extra travel perks. Here’s a quick look at the top options:

1. Visa Credit Cards

A Visa Signature or Visa Infinite card is one of the best choices for Dollar rentals. You can save up to 25% on base rates, get free vehicle upgrades when available, and enjoy built-in rental car insurance that covers damage or theft.

Simply pay with your Visa card and decline the rental company’s coverage. Many Visa cards also let you earn travel rewards or cashback on car rentals.

2. American Express Platinum

If you travel often, the AmEx Platinum card gives you premium benefits with Dollar and other major rental brands.

You’ll enjoy elite status perks like priority service, free upgrades, and discounts of up to 25%. AmEx also provides secondary rental car insurance that covers damage when you pay with your card.

3. Mastercard

Booking your Dollar rental with a Mastercard can save you up to 15%, plus you may get an extra driver and free upgrades depending on promotions. It’s a reliable, traveler-friendly option for smooth payments and added convenience.

4. Discover, Diners Club, and JCB

These cards are also widely accepted at Dollar. While they don’t offer as many rental-specific perks, they ensure secure, quick payments and a hassle-free checkout process every time.

How Long Does It Take for Dollar Car Rental to Return Your Deposit?

When you rent a car from Dollar, they place a temporary hold on your card as a security measure.

If you used a credit card, this hold is usually released within 24 hours after you return the car, but your bank may take up to 10 days to show the funds in your account.

For debit cards, the refund timing depends on your bank’s processing rules. If you paid with cash, and Dollar doesn’t have cash at the return location, they will send you a check within 14 business days.

Always check your rental receipt carefully—sometimes the refunded amount may look smaller due to fees or taxes.

Why Does Dollar Car Rental Require a High Deposit?

Dollar Car Rental requires a higher deposit to protect against potential extra costs during your rental. This includes things like late returns, tolls, or accidental damage to the vehicle.

The deposit is not an extra fee; it’s a temporary hold on your account to ensure all charges are covered when the car is returned.

Typically, the deposit includes your estimated rental cost plus an additional $200–$500 as a safety buffer.

Once you return the car without any issues, Dollar releases the hold, and your bank usually refunds the amount within a few days.

What Happens if You Don’t Have Enough Credit?

If your card doesn’t have enough credit to cover Dollar’s security hold, you won’t be able to pick up your rental car. The hold is there to cover potential extra charges, like fuel, tolls, or damages.

Before booking, make sure your available credit or balance can cover both the rental cost and the hold, which is usually around $200.

If you’re using a debit card, keep in mind that requirements can vary by location—sometimes higher holds or additional ID checks are needed.

How Dollar’s Hold Compares to Other Companies

Dollar’s hold is similar to what you’ll find at other major rental companies. It’s not unusually high or low—it’s designed to protect both you and the company.

Companies like Hertz, Thrifty, and Enterprise follow the same practice. The exact hold can change depending on your payment method, rental location, and car type.

So with Dollar, the hold is standard and in line with industry norms.

Conclusion

Now you know exactly how Dollar’s credit card hold works and why it’s nothing to stress about. It’s a safety measure to keep your rental smooth and secure, covering small, unexpected charges while you drive. The hold is temporary and is released shortly after you return the car.

To make it even easier, check your card balance before pickup, use a major credit card to reduce the hold amount, and follow Dollar’s simple rules.

With these steps clear, you can focus on your trip and enjoy a worry-free rental experience.