Protection must be the priority whether you are driving your vehicle or a rental car. That is why people buy insurance.

But many drivers wonder if their auto insurance covers them when they rent a car. It is a common question because nowadays people often rent a car, especially after an accident, if they do not have their own, or when traveling.

If you know that you are covered by your current insurance policy, you do not need to buy extra insurance and it can save you money too. Well, for USAA members, this is not different.

So, if you are a USAA insurance policyholder, you also must know the answer to “Does USAA Auto Insurance Cover Rental Cars?” If you do not know, this article can surely help you.

What is USAA?

USAA, or the United Services Automobile Association, is known for offering a wide range of insurance products, including auto insurance.

Generally, it is popular among members of the military and their families as it focuses on providing high-quality service and customized insurance plans.

One of the questions that many policyholders have is whether their USAA auto insurance covers rental cars. Let’s continue further to find out the answer to this question.

Does USAA Auto Insurance Cover Rental Cars?

Yes, USAA auto insurance generally covers rental cars but, the coverage depends on your existing policy.

If you have comprehensive and collision coverage on your USAA auto insurance, this naturally covers your rental cars too.

This means if you damage the rental car or it is stolen, your USAA policy will cover it in most cases, similar to how it would cover your own vehicle.

Yes! USAA auto insurance does cover rental cars but it depends on your policy

If you have these coverages on your USAA policy, they will apply to rental cars too:

- Comprehensive Coverage: Covers theft, vandalism, and natural disasters.

- Collision Coverage: Pays for damages if you crash the rental car.

- Liability Coverage: Covers damages you cause to others in an accident.

Note: If you only have liability coverage, USAA will not pay for damage to the rental car.

What Types of Coverage Apply to Rental Cars?

The coverage you get from USAA for rental cars is the same as the coverage you have for your own car.

If you have comprehensive and collision coverage in your auto insurance, you get these protections for your rental cars as well.

Apart from this, your liability coverage, which covers injuries and damages to other people or property in an accident, also applies when you drive a rental car.

| Coverage Type | What It Covers in a Rental Car |

| Liability Coverage | Covers damage to other people or property in an accident. |

| Comprehensive Coverage | Covers theft, vandalism, or natural disasters affecting the rental. |

| Collision Coverage | Covers damage to the rental car from an accident. |

Is There a Deductible for Rental Car Damage?

Yes, just like with your own vehicle, you may have to pay a deductible if you file a claim for damages to the rental car. The deductible amount is the same as what’s fixed on your personal auto insurance policy. This is the amount you will need to pay from your pocket before USAA covers the rest of the repair costs.

Yes. If you damage the rental car, you must pay a deductible before USAA covers the rest:

Example: If your deductible is $500 and the rental car repair costs $2,000, you will pay $500, and USAA will pay $1,500.

You may also know: What Happens If You Scratch a Rental Car?

Does USAA Provide Rental Reimbursement Coverage?

Rental reimbursement is a separate option under USAA auto insurance. It does not automatically come with normal coverage but you can add it as an optional feature.

Rental reimbursement covers the cost of renting a car while your own vehicle is being repaired after a covered accident. The reimbursement limits usually range from $30 to $50 per day, depending on your policy.

- It is optional coverage that helps pay for a rental car while your own car is being repaired after an accident.

Rental Reimbursement is not automatic.

How much does it cover?

- $30–$50 per day (depending on your policy).

When does it apply?

- If your own car is in the repair shop due to a covered accident.

❌ Note: It does not cover rental cars for vacations or personal use.

Does USAA Cover Rental Cars Abroad?

If you are renting a car in another country, USAA’s coverage might not cover it as it does within the United States. You will need to confirm the details and rules with USAA before traveling.

Some countries may need extra coverage, like an international insurance plan, or ask you to buy insurance from a rental car company directly.

Sometimes. USAA rental car coverage may not apply in all countries.

Before traveling abroad:

- Call USAA to check if your coverage applies.

- Some countries require you to buy local insurance from the rental company.

You may also know: Are Pets Allowed in Rental Cars?

Should You Buy the Rental Company’s Insurance?

When people rent a car, the rental company will surely offer you various insurance options. If you have USAA insurance, including comprehensive and collision coverage, you might not need the extra coverage.

However, if you do not have these coverages, or want extra protection, it is good to buy the rental company’s insurance.

You must discuss it with USAA to confirm your specific coverage and whether they cover the rental car before saying no to the rental company’s insurance.

It depends. If you already have USAA collision and comprehensive coverage, you may not need extra insurance from the rental company.

When should you buy rental car insurance?

- If you don’t have USAA collision or comprehensive coverage.

- If you want extra protection to avoid paying a deductible.

- If you are traveling abroad where USAA does not cover rentals.

You may also know: Which Car Rental Companies Allow an Additional Driver Free?

Why Choose USAA Coverage Over Rental Car Insurance?

USAA’s coverage offers several benefits that attract renters to buy it over the rental car company’s insurance. First, it is usually cheaper because you are already paying for your USAA policy. Also, you already have USAA insurance, you do not need to buy extra rental car insurance.

Your existing USAA coverage protects you in the same way it does your personal vehicle, which means you get comprehensive, collision, and liability coverage without buying expensive rental car insurance.

USAA rental car coverage is usually cheaper than buying insurance from the rental company.

USAA coverage benefits:

- No extra cost if you already have collision and comprehensive coverage.

- Covers rental cars like your own car.

- Provides reliable protection for USAA members.

You may also know: Can You Rent a Car with a Temporary License?

Does USAA Cover Personal Items in a Rental Car?

USAA auto insurance does not cover personal belongings inside a rental car. If personal items are stolen from the car or damaged, you will need homeowners or renters insurance to cover these losses. USAA offers both types of insurance, so you can add one of these policies for better protection.

Homeowners insurance covers personal property for people who own homes, while renters insurance covers belongings for people who rent their homes. Both types of insurance can help cover the loss of personal items stolen or damaged in a car.

No. USAA auto insurance does not cover stolen personal items from the rental car.

You need:

- Homeowners Insurance (if you own a home).

- Renters Insurance (if you rent a home).

Note: If you have USAA renters or homeowners insurance, you may get coverage for stolen items!

Does USAA Offer Discounts for Rental Car Insurance?

USAA works with car rental companies like Avis, Hertz, and Enterprise to give discounts to its members. Although these discounts do not directly relate to insurance, they can help you save money when renting a car.

In many cases, rental companies also include basic insurance coverage in these offers and deals, which can be helpful for USAA members.

Yes! USAA members get discounts from certain rental car companies.

Partners that offer USAA discounts:

- Avis

- Hertz

- Enterprise

Discounts can save you up to 25% on rental car costs!

What Happens If You Have an Accident with a Rental Car?

If you meet with an accident with a rental car, USAA will handle the claim just as they will with your own vehicle. You will need to report the accident to both the rental car company and USAA.

Your insurance will cover the accident if you have the right type of policy, like liability, comprehensive, and collision insurance.

If you crash a rental car, follow these steps:

- Call the police if there are injuries or damage.

- Report the accident to the rental company.

- Contact USAA and file a claim.

- Take pictures of the damage.

- Get a copy of the police report (if needed).

You may also know: What Happens If You Crash a Rental Car Without Insurance?

Can You Customize Your USAA Rental Car Coverage?

Yes, USAA allows you to customize your policy with additional coverage options, such as rental reimbursement and increased liability limits.

This gives you full coverage, whether you drive your own vehicle or a rental. It is better to check your policy and make adjustments in your insurance policy if you frequently rent cars.

Yes! You can add extra coverage options, such as:

- Rental Reimbursement Coverage: Covers rental costs while your car is in the shop.

- Higher Liability Limits: Protects you in case of a major accident.

You may also know: Penalty For Unauthorized Driver of Rental Car

Does USAA Offer Roadside Assistance for Rental Cars?

USAA’s roadside assistance coverage can also apply to rental cars if you have added it to your policy. This service helps if your rental car breaks down, needs a tow, or if you lock yourself out of the car.

Remember, the rental company might also offer this service, so check to avoid paying for it twice for the same service.

Yes, if you add it to your policy.

USAA Roadside Assistance covers:

- Flat tires

- Towing

- Jump-starts

- Lockout service

Note: The rental company may also offer roadside assistance, so don’t pay twice for the same service!

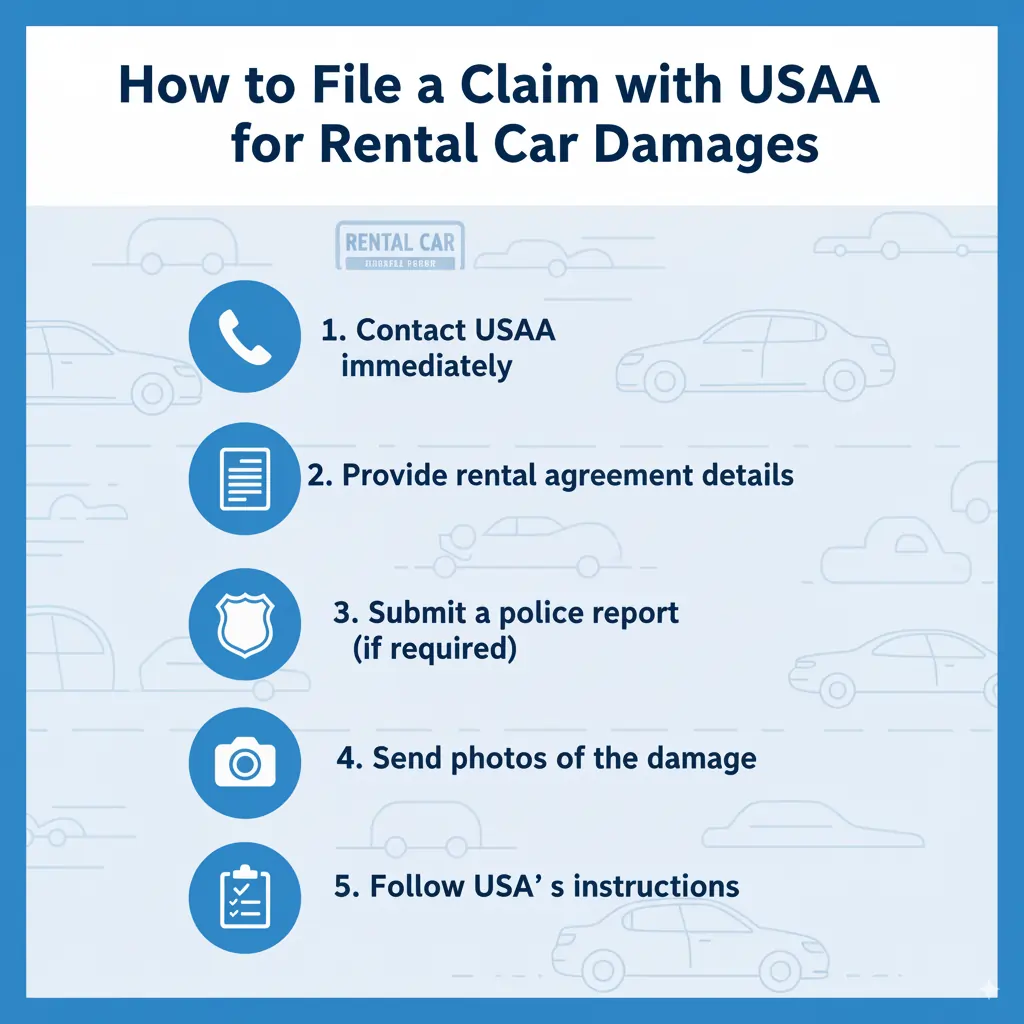

How to File a Claim with USAA for Rental Car Damages?

If the rental car is damaged or faces an accident, you should contact USAA immediately to file a claim. You will need the rental agreement, police report (if required), and any other documentation from the rental car company. USAA will guide you throughout the process to ensure that you get the right coverage.

Steps to file a claim:

- Contact USAA immediately.

- Provide your rental agreement details.

- Submit a police report (if required).

- Send photos of the damage.

- Follow USAA’s instructions to complete the claim.

You may also know: What Happens If You Return an Enterprise Car Late?

What About Rental Cars After an Accident?

If your own vehicle is damaged in an accident and you have rental reimbursement coverage, USAA will help cover the cost of a rental car while your vehicle is being repaired. This helps you to stay on your journey or work without facing high rental costs.

If your car is in the shop after an accident, USAA rental reimbursement coverage will pay for a rental car.

How much does USAA pay?

- Up to $50 per day, depending on your policy.

Conclusion

USAA’s auto insurance is an excellent choice for those who need rental car coverage. Whether you are renting for travel or after an accident, your USAA policy can provide the protection you need.

Always double-check your coverage and, if necessary, add extra options like rental reimbursement. This will help you stay prepared and avoid unexpected costs when you rent a car.

For military members and their families, USAA’s affordable and reliable coverage. It makes it easier to drive with confidence, no matter what vehicle you are in.